For this primer piece, I spoke to people in strategy roles at Huawei and ex-Huawei cloud employees and referenced company information and public reports. Please get in touch if you’re interested in the content or spot anything you think is incorrect. I’m always open to connecting and learning

Nvidia’s Founder and CEO, Jensen Huang, once said that Huawei is among a field of “very formidable” competitors to Nvidia Corp. in the race to produce the best AI chips.

Just last week, Huang visited the Hong Kong University of Science and Technology to receive an honorary doctorate. During a fireside chat with renowned computer scientist and professor Harry Shum, Huang said that he believes the GBA holds a significant advantage in AI development due to its access to talent and capital from companies like DJI, Huawei, and Tencent, as well as top academic institutions such as HKUST (what he referred to as Asia’s MIT). Additionally, the region benefits from mass manufacturing capabilities in nearby cities like Dongguan, Zhongshan, and Guangzhou.

The Greater Bay Area (GBA)—with a total population of approximately 86 million—connects nine major cities in Guangdong province and the unique administrative regions of Hong Kong and Macau. This region is home to many of China’s biggest tech companies, including our protagonist today—Huawei (Shenzhen).

During his fireside chat, Huang emphasized that this area excels in mechatronics, which combines mechanical technology and electronics. He sees opportunities for AI robotics that can comprehend both physical electronics and reasoning intelligence coming out of the GBA. This kind of breakthrough is a perfect example of the need for a company to advance both hardware and software development simultaneously—something Huawei has been actively pursuing.

Huawei was thrust into the limelight in 2018 at the start of the U.S.-China trade war and was caught between a rock and a hard place. As China and the U.S. were going at each other, Huawei’s CFO Sabrina (Wanzhou) Meng, the founder’s daughter, was notoriously detained in Vancouver, Canada, under U.S. orders for over 1,000 days for allegedly breaching sanctions and doing business in Iran.

[Washington has imposed a series of curbs on Huawei and other Chinese companies, claiming that its technological advancement poses a national security risk to the U.S.; meanwhile, Beijing denies such claims and is working to lessen its advanced technology dependency on the West. Today, we’re not here to talk about politics, but this background is essential for understanding the importance of Huawei and its role in China.]

Despite being caught between the two power nations, Huawei initially had no nationalistic goals (speaking to a few employees, they said internally they really don’t see themselves as a nationalistic company, but rather focused and incentivized to compete on innovation).

Huawei’s founder, Ren Zhengfei, once famously said he never wanted to “fight” Americans. The company’s positioning today is an outcome of circumstances. Now, there isn’t much more he can do but play his role and help China’s technology sector progress, which means supporting the country in lessening its dependency on the West.

Ren Zhengfei’s quote translated:

“The United States is hitting us from the north slope today, and we slide down a bit with the snow, then get up and climb again. But one day, both armies will climb to the top of the mountain. At that time, we will not fight the Americans with bayonets; we will embrace and cheer for the victorious assembly of human digitalization, information services, and multiple standards. Our ideal is to serve humanity, not to make money, not to eliminate others. Wouldn’t it be better if we could all serve humanity together?”

[任正非原话是这么说的:美国今天把我们从北坡往下打,我们顺着雪往下滑一点,再起来爬坡。但是总有一天,两军会爬到山顶。这时我们决不会和美国人拼刺刀,我们会去拥抱,我们欢呼,为人类数字化、信息化服务胜利大会师,多种标准胜利会师,我们理想是为人类服务,又不是为了赚钱,又不是为了消灭别人,大家共同能实现为人类服务不更好吗]

So, as we dive into Huawei’s AI strategy, there are three overarching things to keep in mind that drive the company’s investment, resource allocation, and product design:

- The company’s “All-Intelligence Strategy” aims to bring industry solutions. That means their solutions are not focused on being tailored for companies but rather on bringing together resources across public and private sector players to tackle industry-wide issues. Its goal is to find the best solutions for industry use cases, whether in mining, transportation, weather prediction, or energy.

- The proprietary model Pangu is to serve enterprises first and foremost, and in my simplified version of the explanation – it has three layers:

- Layer 0 is what you can think of as the raw models, and anyone can use them to train their own data

- Layer 1 consists of industry-specifically trained models

- Layer 2 is essentially APIs for you to plug and play; it’s much more cost-effective but less flexible

- Huawei has created a comprehensive ecosystem and long invested in cloud, hardware, and various touchpoints with enterprises and consumers (far before AI became hot). So, one of their most significant advantages is tapping into experiences and know-how across different technologies, synthesizing and finding synergy and cross-offerings in this virtuous cycle.

Zhang Pingan said, “Pangu models were born to serve industry-specific needs, and we are here to help customers from every industry to develop and use large models to solve their problems in ways never seen before.”

All Intelligence Strategy: Huawei’s Six-Year Grind

At Huawei Connect 2024 in September, Eric Xu, Huawei’s Deputy Chairman and Rotating Chairman, outlined the company’s AI strategy in great detail at Huawei Connect 2024 in September this year. He said that AI is becoming the most impactful technology across industries, and each use case can be different. It has taken the company six years to reach its breakthrough in innovation.

As mentioned before, Huawei’s primary focus has always been within the enterprise, frankly less so on consumer solutions. So, when it comes to AI, Eric emphasized that the company’s focus is still on enabling intelligent enterprises.

The company has identified the “six A’s” that it uses to define its objectives: Adaptive User Experience, Auto-Evolving Products, Autonomous Operations, an Augmented Workforce, All-Connected Resources, and AI-native infrastructure.

Adding, looking ahead, “In 2024 and over the next five years, Huawei will invest even more into ecosystem development” with partners across the stack, adding that the company’s “All Intelligence” strategy and mission to build AI systems is to make the technology “accessible to every person, home and organization,” said Xu.

As you can see, its ambitions and efforts encapsulate everything across the stack. However, as a hardware company foremost, Huawei’s competitive advantage is still within its hardware (and software integration into its hardware).

Infrastructure Stack: Huawei Ascend 910B(C)’s Ambitious Plans

Due to the U.S. chip ban last year, Nvidia could no longer sell its most advanced chips to the Chinese market, which used to make up nearly 25% of its sales. The U.S. company then made adjustments to circumvent certain restrictions, creating alternative versions of their chips, like the A800, which operate at reduced processing speeds compared to the A100 and H100. This allows them to continue selling products while adhering to U.S. laws. But then Huawei rolled out its most advanced chips, the Ascend 910CB, and the later upgraded 910Cs that are often said to be the closest competitor to American-made Nvidia’s advanced chips, the H100s, making China more likely to remove its dependency on U.S. technology in the AI arms race.

AI Uncovered is a YouTube Channel I found that makes short explainer videos on topical AI issues.

China has historically accounted for about 20% to 25% of Nvidia’s annual sales. As the chip ban took effect, Chinese AI companies began buying and hoarding inventory. However, Huawei’s launch of the Ascend 910B and then 910C completely disrupted the ecosystem in China and emerged as the most viable alternative to Nvidia’s sought-after A100 chip.

In its 2023 annual report, Nvidia listed Huawei among its “formidable” competitors in the AI field. This includes Huawei’s mobile-use Kirin 9000s SoC and AI-focused Ascend chip offerings.

Nvidia Corporate Material

“The reality is that US restrictions on AI chips for China are unlikely to be lifted any time soon,” Eric Xu said at the Huawei Connect 2024 event.

Huawei has always focused on hardware development and far less on software innovation than its peers in China. Even when developing software products, the company focuses on enterprise software (I’m getting repetitive, I know, but I’m trying to make a point).

For Huawei, the U.S. chip ban, in a way, can be seen as a blessing in disguise – as it’s by default made Huawei the only company with advanced AI chips that are commercially available and could even match those of Nvidia in the Chinese market. If anything, it has helped Huawei completely monopolize the domestic demand.

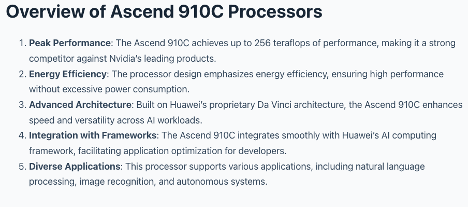

Let’s first take a look at the overview of the 910C based on Techovedas’ analysis.

Huawei’s critical issue is that it cannot produce enough of these chips on time. Just last week, Reuters reported that Huawei will mass-produce its most advanced AI chips in the first quarter of 2025 despite struggles to make enough processors due to U.S. export curbs. The report pointed out that the more significant issue is that SIUIF is making the 910C on its N+2 process. Still, due to the unavailability of advanced lithography equipment, the chip’s yield has been limited to about 20%.

This yield percentage means that only 20% of the chips produced from a silicon wafer are functional and meet quality standards. However, the industry norm is that advanced chips require yields of over 70% to be commercially viable.

The report added that even Huawei’s processor 910B only has a yield of about 50%, which has led to Huawei cutting production targets and delaying fulfilling orders for that chip. In the same Reuters report, it is said that one of its key customers is TikTok’s parent company – ByteDance, which had ordered more than 100,000 Ascend 910B chips this year but received less than 30,000 as of July this year.

For context, Huawei’s lack of the necessary material is due to the U.S. ban, which includes barring China since 2020 from obtaining extreme ultraviolet lithography (EUV) technology from the Dutch manufacturer, as well as what is more widely talked about—not allowing TSMC to sell advanced chips to China.

We are taking a closer look at the specs.

Huawei vs Nvidia (Perplexity provided in the chart below)

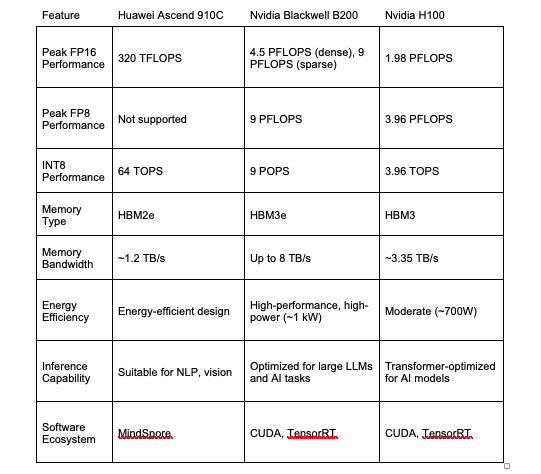

Since the ban on Nvidia’s chips in China, Huawei has been widely compared to Nvidia in this area. Below is a detailed comparison of the Huawei Ascend 910, Nvidia H100 GPUs, and Nvidia’s most advanced chip – Blackwell B200- based on performance metrics, use case differences, and inference capabilities.

Performance Gap

- The Nvidia Blackwell B200 is significantly more potent than the Ascend 910C and the H100 in raw computational performance, particularly its FP4/FP8 tensor cores optimized for AI workloads.

- The Ascend 910C lags far behind peak performance but emphasizes energy efficiency and cost-effectiveness.

- The Ascend 910C is said to be the most viable alternative to Nvidia’s A100 chip in the Chinese market for high-performing tasks.

Use Case Differences

● Ascend 910C: Primarily designed for AI tasks like natural language processing (NLP), image recognition, and autonomous systems within China’s ecosystem. It lacks the flexibility and software ecosystem of Nvidia GPUs.

● Blackwell B200: Dominates in training and inference for large language models (LLMs) and generative AI due to its high memory bandwidth and advanced tensor cores.

● H100: Optimized for transformer-based models with its Transformer Engine and FP8 precision, making it ideal for generative AI workloads.

Inference Ability

● The Blackwell B200 achieves up to 15x higher inference performance than the H100 in large-scale LLMs.

● The H100 delivers strong inference capabilities but outperforms the Blackwell B200 in next-gen applications.

● The Ascend 910C is competitive in inference within China but needs more software support.

The Ascend 910 chip is designed to perform at a level similar to Nvidia’s A100 chip, which is well-known for its powerful computing abilities. It is made using advanced 7nm technology, allowing it to pack in a remarkable 69,000 AI processing units. This chip has earned its reputation for being very energy efficient.

Here, insert the Da Vinci Architecture, a proprietary technology developed by Huawei that serves as the backbone of its AI computing solutions, particularly within the Ascend series of processors. It supports various data types, including FP16 and INT8, making it suitable for training and inference in machine learning applications. It is essentially integrated into the 910 chips to enhance computing power and efficiency.

So, here’s a quick rant from me: What is inference?

Based on Oracle’s definition, AI inference occurs when an AI model trained to recognize patterns in curated data sets recognizes patterns in data it has never seen before. As a result, the AI model can reason and make predictions that mimic human abilities.

Despite Huawei’s AI prowess right now, Kevin Xu at Interconnected recently wrote that the catch-up from Huawei’s end will be short-lived, as Nvidia’s newly launched Blackwell system floods the U.S. AI ecosystem in 2026, it will completely throw the Chinese counterparts behind in this race again. That is something for us to explore another time.

PULL QUOTE

Leo Jiang, Founder of GroundAI and former Chief Digital Officer at Huawei, said that Huawei has unique strengths. First, the company is the world’s second-largest company by its investment in R&D, after Alphabet, which gives strategic investment and endurance to long-term chip design. Second, the company’s DNA is in hardware design and manufacturing. Third, owning the leading Chinese semiconductor company HiSilicon gives it a massive advantage over its peers. Lastly, its end-to-end capability, from material science, chip design, manufacture, and cloud stack to its operating system, is unparalleled globally. All together, they create a compelling ecosystem.

Infrastructure Layer: Huawei Cloud and its role in AI

Looking closely at Huawei’s journey into cloud computing, I was shocked to find it began in 2005, making it one of the earliest entrants in the space. It started venturing into this field even before significant players like Amazon Web Services (AWS) launched their services. Huawei is currently China’s second-largest cloud service provider, following Alibaba and followed by Tencent.

Huawei has usually been better known for its hardware, competing with companies like Cisco and, as mentioned earlier, Nvidia, especially in its earlier days when it was known for its advanced networking hardware.

However, when cloud computing began to gain traction globally, Huawei recognized the potential of offering cloud services to complement its existing hardware business. It is said that Sabrina (Wanzhou) Meng herself has been an adamant advocate for the cloud and should take credit for the company’s strategic decision to invest in the cloud business in its early days.

Despite Huawei’s head start in this business, it was slow to invest heavily in cloud technologies. Its initial strategy primarily focused on expanding its consumer electronics and telecommunications divisions. While domestic competitors like Alibaba Cloud surged during the rapid growth of the Chinese internet sector in the 2010s and became the number one in the market, Huawei Cloud remained somewhat sidelined until the last ~7-8 years.

This strategic move signaled a renewed focus on cloud services and an ambition to capture market share from leading providers like Alibaba. The initial strategy involved targeting government contracts for private cloud solutions, aligning with Huawei’s strengths in hardware and services. So, even today, many of Huawei Cloud’s largest customers are state-owned enterprises in China (SOEs). In contrast, Alibaba and Tencent have a more diverse customer pool, mainly from the private sector.

Huawei Cloud doesn’t tout itself as the fastest, but it often prides itself on robust security compliance, having obtained over 140 security certifications globally. This makes sense, whether for operational purposes or PR reasons, because, as mentioned, many SOEs and sometimes sensitive sectors require that reassurance to migrate to the cloud.

Some people like to compare Huawei’s cloud business to Google Cloud Platform (GCP), mainly because Huawei each has a mobile operating system built on the infrastructure of its vital cloud service. We’ll discuss Huawei’s mobile phone operating system further down.

Launched in 2008, GCP has transformed from a modest offering into one of the leading cloud service providers globally, competing with giants like Amazon Web Services (AWS) and Microsoft Azure. As of late 2024, GCP holds approximately ~10% market share in the global cloud market, making it one of the top three cloud providers alongside AWS and Microsoft Azure. GCP’s customers are primarily blue chips you have heard of, such as Spotify, Twitter, and eBay globally.

When comparing the two’s market shares, Huawei Cloud holds approximately ~19% of the Chinese market, making it the second-largest provider in the region after Alibaba Cloud. Meanwhile, according to Canalys reports, GCP commands about ~11% of the global cloud market share.

Both big tech’s cloud services have played a major role in their enterprise servicing end and are now able to leverage their cloud capacity for their AI development. But in general, it’s very hard to compare these companies when they have very distinct business models.

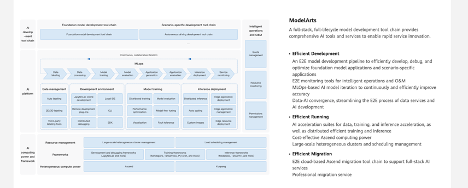

Huawei ModelArts

At this point, I’m getting quite confused because there are so many names and layers to remember. So bear with me while I work these terminologies out myself. There are the ModelArts, Pangu models, the Da Vinci Architecture, the Ascend Ecosystem, and the HarmonyOS Operating System. Let’s just take a deep breath and zoom into ModelArts here very quickly so that I can introduce you to the Pangu Models. Thank you for your patience in staying with me until this point.

Huawei’s ModelArts is an AI development platform that simplifies creating, training, and deploying machine learning models. It aims to support novice and experienced developers with data preprocessing, model training, and real-time inference tools. The platform includes ExeML, which allows users to build applications without coding and utilizes Huawei’s Ascend chips to improve performance and efficiency. ModelArts offers flexible deployment options for cloud and edge environments and provides access to pre-built algorithms through its AI Gallery.

Eric Xu at Huawei Connect 2024 said that Huawei Cloud has recently upgraded the ModelArts services to provide out-of-the-box access to mainstream foundation models, including Pangu, open-source, and third-party models. This means that the companies that choose to use Huawei’s services won’t need to prepare mass amounts of data for multiple iterations of model training themselves.

He also highlighted that Pangu Models 5.0 includes models with over 1 billion, 10 billion, and 100 billion parameters and even more parameters for companies to find the best fit for their unique business needs.

Model Layer: Huawei’s Pangu

I’m definitely not the first to highlight Huawei’s relevance in the future of GenAI, primarily as it builds out its Ascend AI ecosystem. This Forbes article by Professor Mark Greeven puts it quite cleverly, calling the Pangu Model 5.0 The Brains, whereas HarmonyOS NEXT the soul (which we’ll go into below.) Huawei’s Pangu Model 5.0 is primarily known for excelling expectations in handling tasks across text, images, videos, and audio, adapting to various languages and scenarios.

Huawei’s Eric Xu highlighted that the company sees this world as having two types of companies they can serve:

1) the ones that need Huawei’s infrastructure service to build their models, which they serve through their cloud business;

2) those that won’t need to train a proprietary foundation model.

So, Pangu is here to serve the latter type, as teaching a model can require a lot of data and be costly in terms of time and capital. The Pangu models have been tested across industries (Olivier Gomez writes in detail about how different industries have adopted Pangu here on LinkedIn @oliviergomez), and based on Huawei’s experiences, a 1-billion-parameter model is most likely enough for most company’s use cases. Its applications span diverse sectors, including autonomous driving, industrial design, meteorology, and pharmaceuticals. One of its most (random) but popular commercialized models is probably its Pangu Meteorological Model, which offers extremely precise weather forecasts that have been widely adopted globally.

As mentioned before, the Pangu Models 3.0 uses a “5+N+X” three-layer architecture and this is critical to understand. Based on their own explanation:

● The L0 layer consists of five foundation models: NLP, CV, multimodal, prediction, and scientific computing, which provide general skills to power an endless possibility of industry-specific applications. [So companies who want to use their own data to train the models, adjust the applications to their preferences, and have the capabilities and money to invest in the model can choose this offering]

● The L1 layer consists of N industry-tailored models. Huawei Cloud can provide customers with industry models it has trained on open industry datasets, including Pangu models for government, finance, manufacturing, mining, and meteorology. Alternatively, customers can train their own models using their own datasets based on Huawei’s L0 or L1 Pangu models. [This is for companies with capital to invest and technological capabilities but want something a bit more sophisticated or only want to make minor tweaks to the model]

● The L2 layer provides pre-trained models for specific industry scenarios and tasks, such as intelligent government hotline, intelligent branch assistant, lead compound screening, conveyor belt foreign object detection, and typhoon trajectory prediction. These models can be quickly deployed off-the-shelf. [This is for users who want the finished product, an API plug-in. With the least amount of time, money, and effort needed but the least tailor-made.]

What does this mean for real-life applications?

What this means is that “this decoupled, hierarchical architecture allows the Pangu models to be quickly adapted to a wide range of downstream tasks.” Customers, whether in the private or public sector, can choose the level of product readiness based on their specific needs and capabilities. They can input their own data, upgrade foundation models, or enhance specific capabilities. Additionally, Pangu models support multiple deployment options, including public cloud, a dedicated large model zone within the public cloud, and hybrid cloud solutions. This flexibility ensures that diverse security and compliance requirements are met for different customers.

Operating System Layer: Huawei’s HarmonyOS NEXT

Now, Huawei has integrated Ascend’s computing power and Pangu Model’s capabilities into the HarmonyOS NEXT operating system. This means Huawei phones are now equipped with AI-driven features such as AI Drawing, AI Removal, and AI Voice Repair, paving the way for the average user experience on the application end and creating extra touchpoints for users’ adaptability to AI. This brings us full circle to Huawei’s grand AI strategy.

The WSJ reported last week that Huawei is expected to reveal its most advanced domestic phone chip very soon. The upcoming Mate 70 series will reportedly feature the HarmonyOS NEXT software, showcasing its success with users.

Huawei phones have been praised for being highly user-friendly (primarily in China), boasting sleek designs and built-in advanced camera filters. Prices range from $250 for the Huawei Enjoy 50, aimed mainly at developing nations, to over $3000 for the Huawei Mate, which is one of the iPhone’s main competitors in the Chinese premium smartphone market.

In Asia, many people compare Google’s Android system to HarmonyOS simply because the iPhone is in its world, making these two the most widely used non-Apple systems.

Given that Android is an open-source operating system, it’s been adopted by the other two key smartphone players in Asia, Samsung and Oppo, which are still making it a market leader. But HarmonyOS Next can work seamlessly across multiple device types, including smartphones, tablets, wearables, and IoT devices. It allows more user customization regarding the buttons and screen control than the Android system, winning over some loyal users.

Regarding AI, the recent Android version has incorporated AI features such as Google Assistant, but it cannot be accessed in China due to the Great Fire Wall. HarmonyOS has similarly included voice assistance, Xiaoyi, but as mentioned above, it has also integrated a series of tools that can provide document analysis or intelligent reminders. Overall, the Android app ecosystem is obviously significantly larger. Where Harmony beats it, is that its apps are designed to be seamless across devices, and it currently offers many more sophisticated consumer-facing AI-integrated tools than its competitors.

Final Words

To reiterate, what MANY experts I spoke to kept saying is that companies like Huawei (and Alibaba, for that matter – I wrote a deep dive on BABA) cannot be compared to their so-called American counterparts because Nvidia continues to lead in chips and OpenAI on LLM development.

However, that does not minimize the strides companies like Huawei and Alibaba are making at every single touchpoint of this ecosystem. These Chinese big techs have this massive competitive advantage that is often overlooked: the ability to take learnings and resources from within the conglomerate. This may be due to regulatory reasons or the nature of Chinese/ U.S. industry practices – where it is just not as easily done so in the U.S.

Although Huawei vs. Nvidia or Google are not the most Apple-to-Apple comparisons. Huawei’s businesses can almost be seen like Nvidia + Google, as it runs from infrastructure to the cloud, even to the edge devices such as tel-communication devices and industrial digital power products, and it even expands to the operating system and consumer devices such as phones, tablets, and smart automotive. It has truly encapsulated the whole value chain of today’s industrialized technology production and, in a way, is similar, to if we were to combine Nvidia and Google’s businesses in the U.S.

Above all, as a private company whose founder owns less than 1% of the company, rather than listing the company under the influence of Wall Street, Huawei has remained true to its founding mission and vision—” to bring digital to every person, home, and organization for a fully connected, intelligent world.”

And all the politics aside, we cannot deny the innovation, scale, and influence the company has made, not just on China’s technology, internet, and artificial intelligence space but – globally.

If you want to keep tabs on the shifts taking place in the AI world, subscribe to the AI Business Asia weekly newsletter to stay ahead of the curve.

Subscribe To Get Update Latest Blog Post

Leave Your Comment: